Pershing Square Holdings accrued 12.7 million shares of Hertz stock throughout 2024.

April 18, 2025 at 07:47

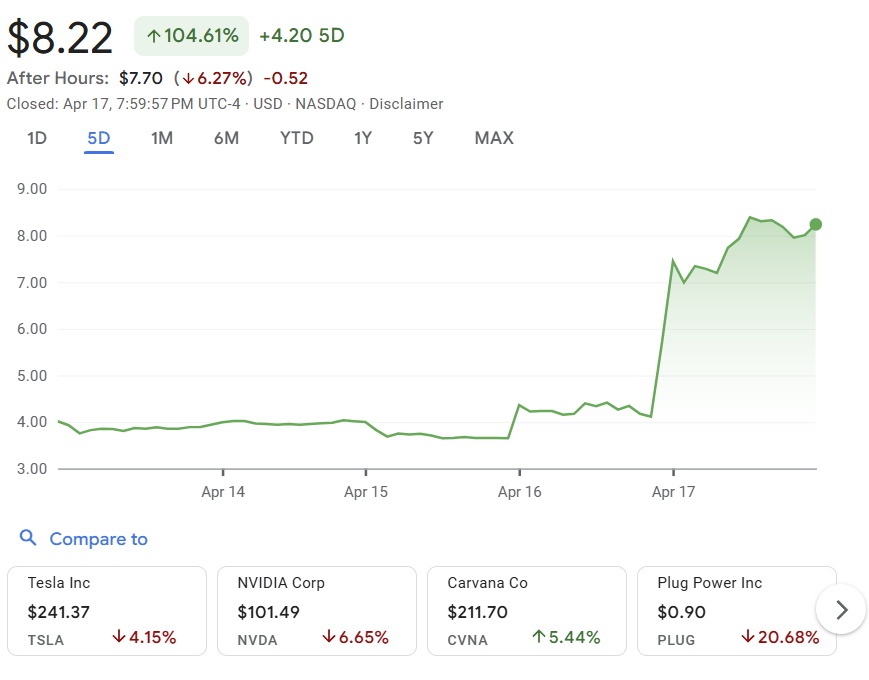

- Hertz shares soared by over 120 percent after Pershing Square revealed its stake.

- Bill Ackman’s firm now controls nearly 20 percent of Hertz through shares and swaps.

- Last year, Hertz lost an extraordinary $2.9 billion and hopes to reverse its fortunes.

Hertz has had a whirlwind five years. At the height of the Covid-19 pandemic in early 2020, the rental car giant missed lease payments on its fleet and, by May, filed for Chapter 11 bankruptcy. But it didn’t stay down for long. The company soon re-emerged from bankruptcy and, in 2021, committed to buying over 100,000 EVs from Tesla and other automakers. Now, Hertz has attracted a major new investor, one who just sent its stock into a frenzy.

More: Hertz Employees Abandon Post, So Customers, Including Denver’s Mayor, Just Drive Off

Pershing Square Holdings, operated by billionaire businessman and investor Bill Ackman, has announced that it has recently accrued 12.7 million shares of Hertz stock. This works out to be roughly a 4.1% share of the company and immediately sent the share price to the moon, rising by over 120% to end the day at $8.22.

Ackman Bets Big on a Turnaround

“We began accumulating shares in Hertz late last year,” Ackman posted on X, confirming Pershing Square’s position. He described Hertz as “an operating company combined with a highly leveraged portfolio of automobiles,” and acknowledged past missteps, most notably the company’s overzealous purchase of Teslas, which led to operating headaches, soft demand, and a painful hit to resale values after Tesla slashed its prices.

Ackman’s investment firm acquired its shares in Hertz through 2024. Importantly, CNBC understands that through shares and swaps, its total position in Hertz actually sits at 19.8%. It’s little wonder, then, that the market responded so positively to Ackman’s significant investment in the company.

Sources say Pershing Square was granted an exemption by the US Securities and Exchange Commission that allowed it to delay publicly disclosing its holdings until this week, despite acquiring a significant portion of shares last year.

Ackman’s arrival comes at a critical time for Hertz. In February, the company reported a $2.9 billion loss for 2024. A $245 million hit came from downsizing its EV fleet during the fourth quarter. That may have been painful for shareholders, but for EV buyers, it opened a rare window of opportunity. Hertz has been unloading electric vehicles at steep discounts in recent months.

Read: Hertz Hackers Stole Customers’ Personal Data And License Records

Hertz has been so eager to downsize its fleet of EVs that in December, it was revealed customers currently renting an EV were being sent emails offering them the chance to buy the car on the spot. In one case we reported on, an individual renting a 2023 Tesla Model 3 was offered the chance to buy it for just $17,913.

A Long-Term View

Despite the financial challenges, Ackman is bullish on Hertz’s outlook. He pointed to a few reasons for optimism, including “an improving industry structure and more rational competitive behavior,” and a new leadership team with experience in similar industries. He also noted that Hertz’s fleet rotation strategy is beginning to pay off, saying the company has “already made meaningful progress in rotating out higher cost vehicles that had temporarily elevated depreciation expense.”

Ackman believes these efforts, combined with pricing improvements across the industry, could eventually deliver substantial returns. He even floated a longer-term valuation target of around $30 per share by 2029, based on projected earnings and market conditions.

We began accumulating shares in @Hertz late last year, and as of today, we have a 19.8% stake in the company comprised of outright share ownership and total return swaps.

Hertz can be thought of as an operating company combined with a highly leveraged portfolio of automobiles.…

— Bill Ackman (@BillAckman) April 17, 2025